Top Mobile Gaming Apps of May

Last month, the mobile download leaders were not defined by novelty, but by execution - games that combined algorithmic user acquisition with local-market savvy, lightweight builds, and gameplay loops refined for maximum retention. Block Blast! extended its streak at the top, not through innovation, but via surgical UA and dense release cadence. Roblox turned branded IP into engagement engines, folding real-world partnerships into its sandbox. Garena Free Fire held ground in bandwidth-constrained regions through asset optimisation and live ops tuned to cultural moments. Meanwhile, Ludo King proved again that offline-friendly, generationally familiar games remain resilient when paired with regional promotion and simple monetization. Last month's winners, and losers, is less about what’s new than about how well the old can be re-weaponised.

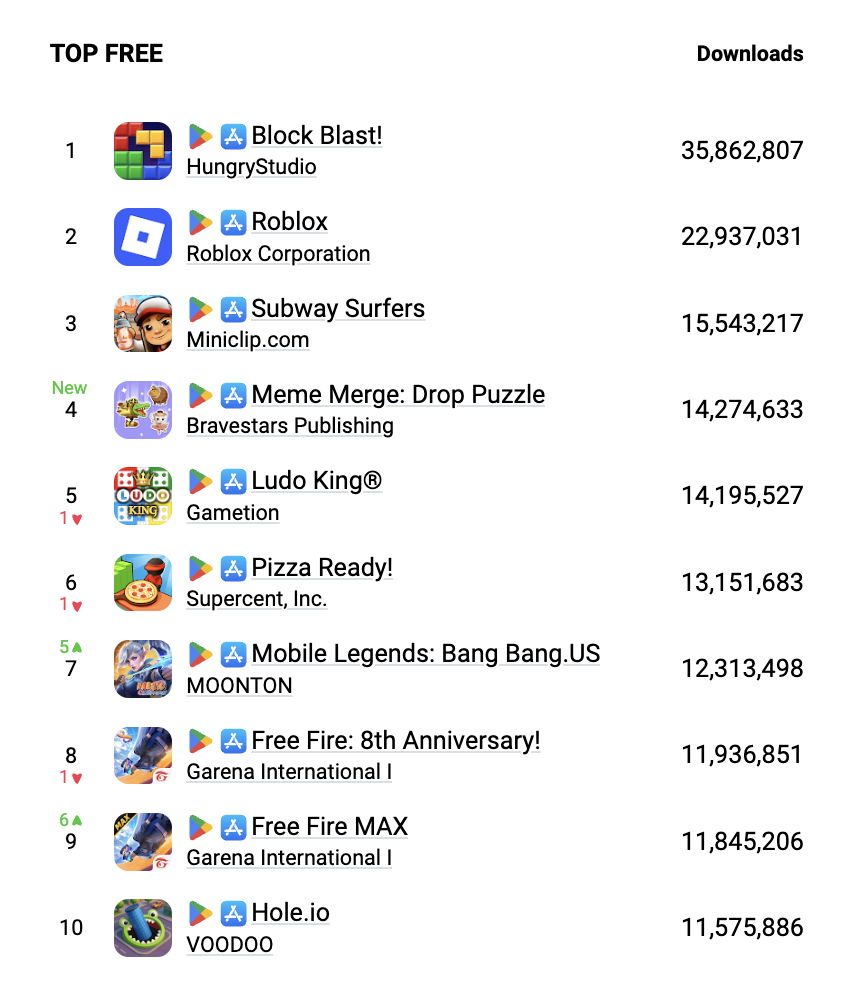

Top 10 Free Games

Based on highest downloads:

In May 2025, top free mobile games were led by titles combining broad accessibility, strong UA strategies, and effective retention mechanics. Block Blast! maintained its #1 rank through simple match-3 gameplay, frequent content updates, and aggressive user acquisition via hyper-targeted ad campaigns, driving 39–40M installs monthly. Roblox leveraged user-generated content and IP tie-ins (e.g. NFL Universe, Sanrio) to sustain virality and engagement across platforms, with monetization through Robux and social-driven UA Garena Free Fire capitalised on lightweight design and live ops - like April's “Midnight Ace” update - to maintain global appeal, particularly in India and Brazil, with IAP-heavy monetization and high-volume social UA. Subway Surfers remained resilient due to regular themed updates, easy gameplay, and influencer-driven campaigns, monetizing via IAP for cosmetics. Ludo King sustained downloads through its offline-friendly multiplayer design and broad family appeal, supported by ad-based monetization, regional UA investment, and app-store promotion.

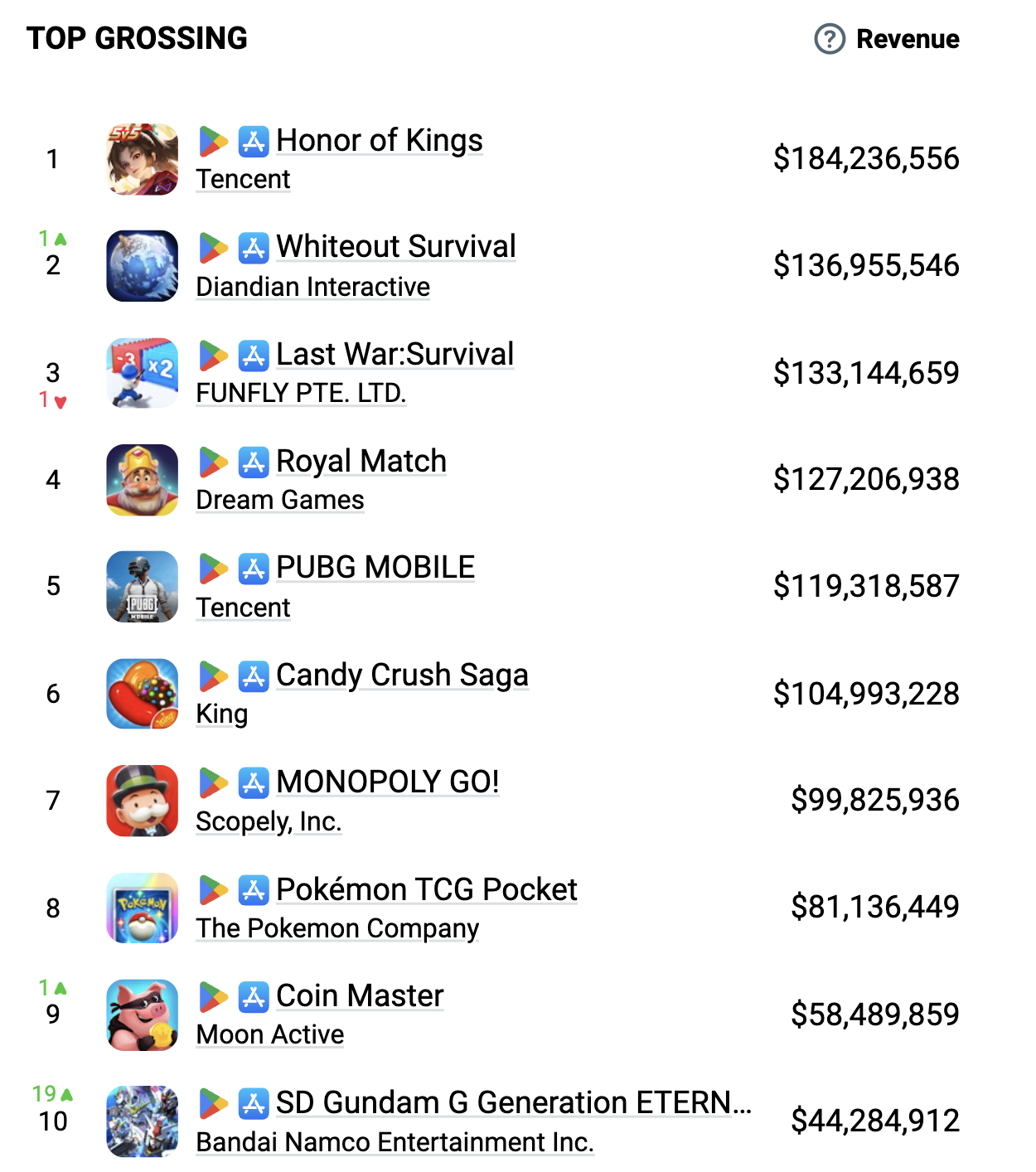

Top 10 Grossing Mobile Games

Based on highest revenue - estimated IAP revenue by platform fees and taxes:

In May, Honor of Kings topped the grossing charts with over $184M, driven by gacha monetization and seasonal content. Whiteout Survival and Last War: Survival followed with $137M and $133M respectively, leveraging PvP, hero packs, and event-driven IAP spikes. Royal Match earned $127M through polished match-3 design and battle pass subs, while PUBG Mobile and Candy Crush Saga grossed $119M and $105M via cosmetics, boosts, and long-term player spend. MONOPOLY GO! ($100M), Pokémon TCG Pocket ($81M), Coin Master ($58M), and Honkai: Star Rail (exact May revenue not cited, but spiked post-April banner) rounded out the top ten with strong social loops, gacha systems, and time-limited bundles.

Top Trending Mobile Games - Gainers

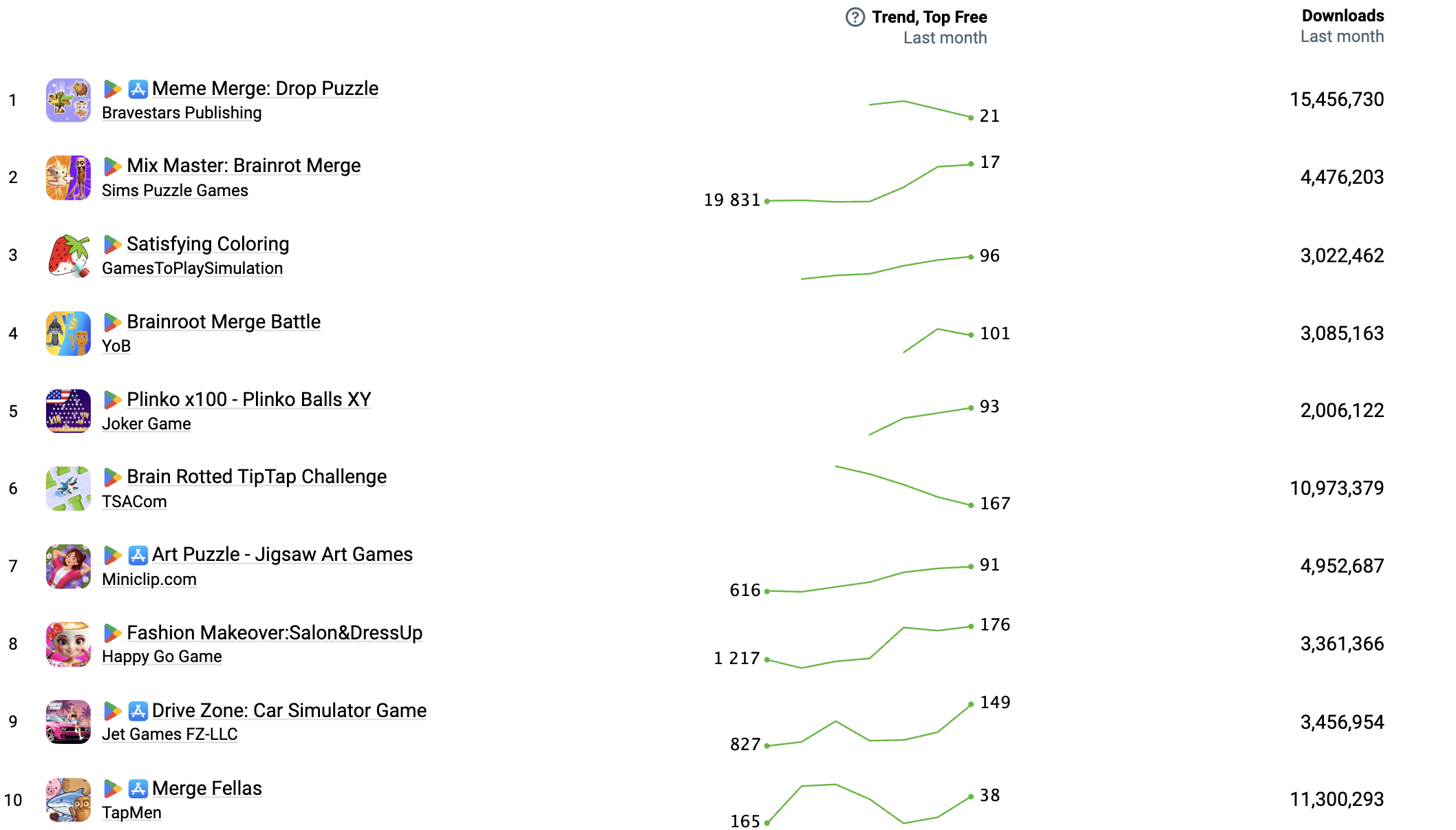

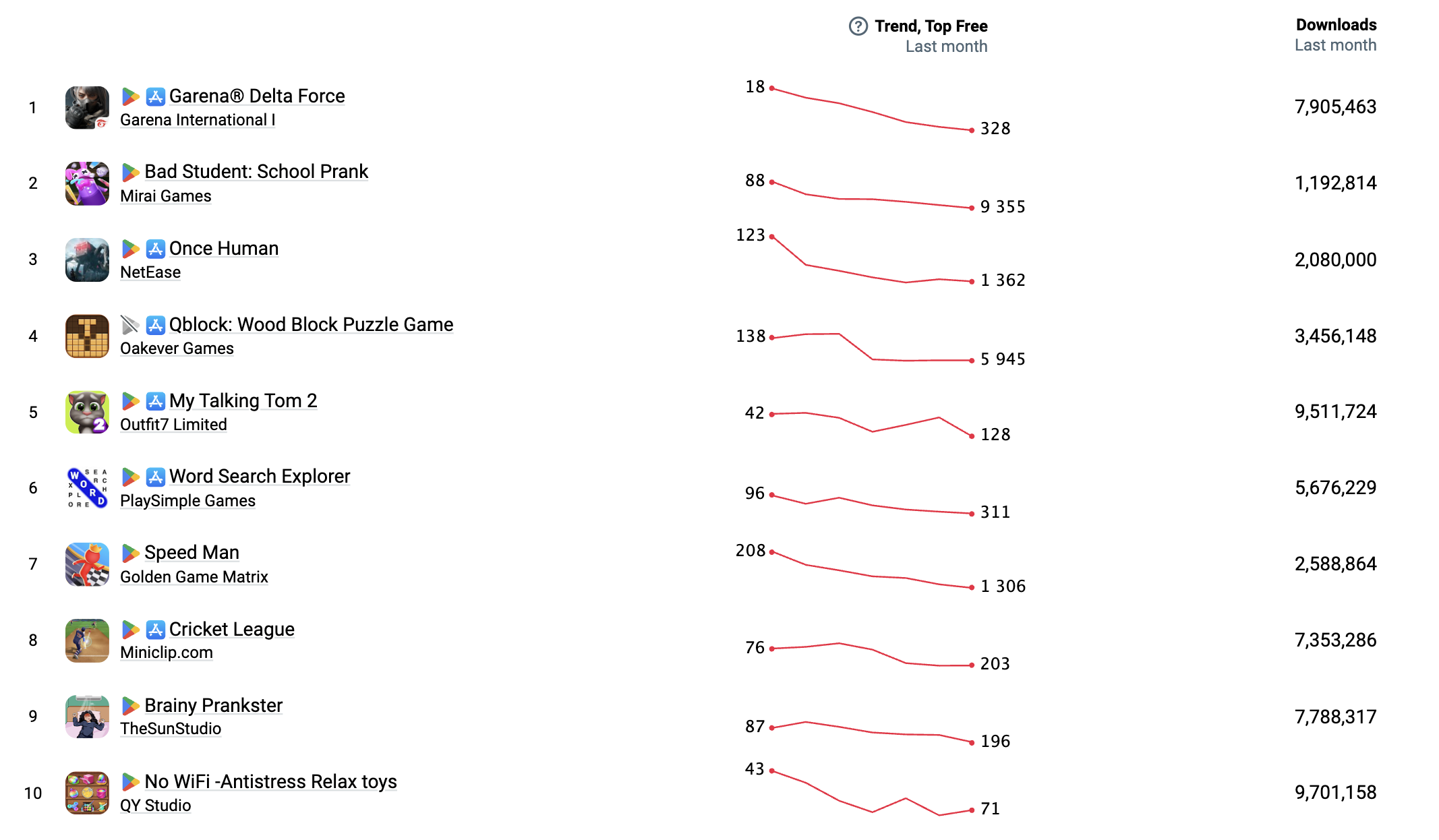

Top Free

The green line shows the app's performance in the Top Charts over May - the left side indicates the starting position, and the right indicates its current position:

May’s top mobile downloads were driven by meme culture, hypercasual mechanics, and short-form video virality. Titles like Meme Merge, Mix Master, and Merge Fellas capitalised on Gen Z humor and TikTok ads, each exceeding millions of installs. Casual and sensory-driven games like Satisfying Coloring and Art Puzzle tapped into ASMR trends and puzzle familiarity. Brainroot Merge Battle and TipTap Challenge fused quirky gameplay with aggressive social UA, while Drive Zone and Plinko x100 leveraged strong visuals and arcade appeal. Fashion sims continued to thrive via influencer targeting. Most were ad-monetized, Android-first, and scaled through meme relevance and low-friction installs.

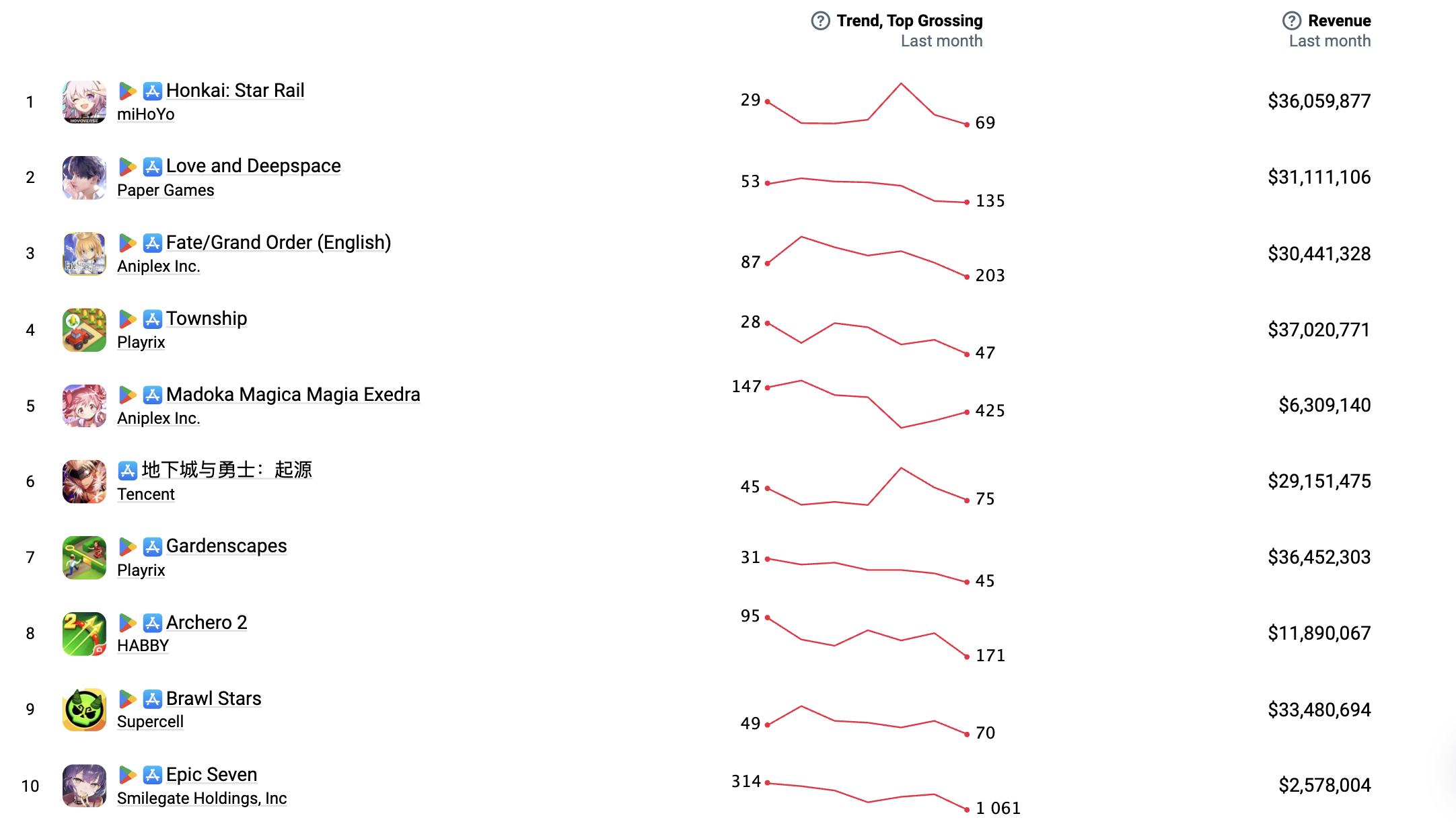

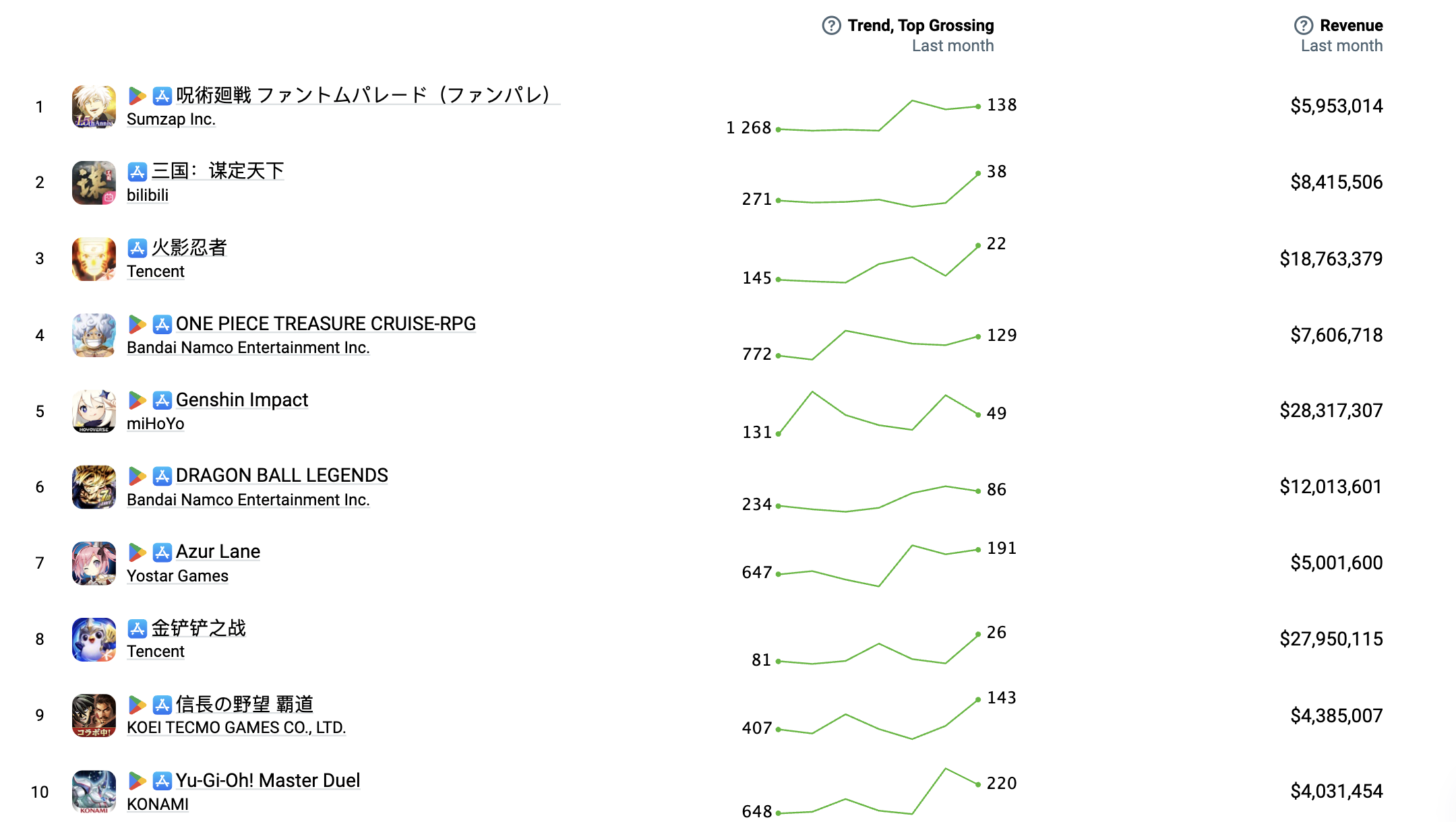

Top Grossing

Revenue indicates IAP revenue reduced by platform fees and inclusive taxes:

May’s top-grossing mobile games were all franchise-driven, with IPs like Jujutsu Kaisen, Naruto, Genshin, and One Piece anchoring engagement. Revenue was fueled by gacha monetization, battle passes, and limited-time banners across all titles. Consistent live-ops with character drops and timed events maintained spending momentum. User acquisition was boosted by anime tie-ins, influencer campaigns, and seasonal crossover events. Most revenue originated from Asia, especially Japan and China, where iOS and regional Android stores dominate. Publishers like Tencent, miHoYo, and Bandai Namco leveraged deep live-service infrastructure and fan loyalty.

Top Trending Mobile Games - Losers

Top Free

Top Grossing